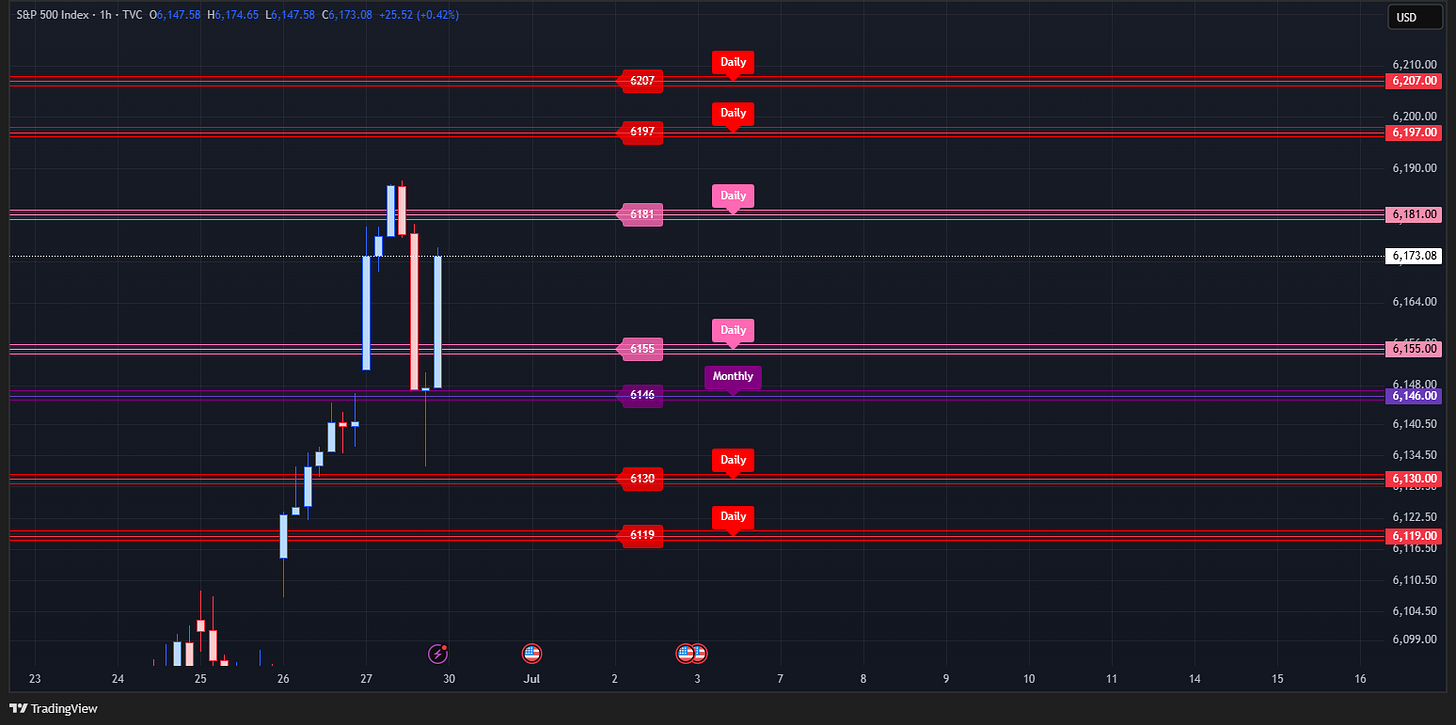

Levels for Monday are in the chart and listed below:

🎯 Daily SPX Levels:

6207-Red

6197-Red

6181-Pink

6155-Pink

6131-Red

6119-Red

🎯 Weekly SPX Levels:

NA-Blue

NA-Blue

🎯 June SPX Monthly Range:

6146-5615-Purple

🎯 String Input: Copy and Paste this into the Indicator

6207,6197,6181,6155,6130,6119,0,0,6146,5615

Red and Pink Levels are updated Daily. (Daily Levels)

Blue Levels are updated Weekly before Mondays open. (Weekly Levels)

Purple Levels are updated beginning of each Month. (Monthly Range)

If necessary, I will provide additional daily levels in Substack’s chat thread to account for market gaps.

Levels Converted to ES Below:

🎯 Daily ES Levels:

We are now using September Contract.

Manual ES Spread=51.5

6258.5-Red

6248.5-Red

6232.5-Pink

6206.5-Pink

6181.5-Red

6170.5-Red

🎯 Weekly ES Levels:

NA-Blue

NA-Blue

Levels Converted to SPY Below:

🎯 Daily SPY Levels:

Manual SPY Ratio: 10.04

618.23-Red

617.23-Red

615.64-Pink

613.05-Pink

610.56-Red

609.46-Red

🎯 Weekly SPY Levels:

NA-Blue

NA-Blue

📣 Key News Events This Week:

But first here is how I treat news events. Rather than attempting to forecast where the market will head during these news events, I see them as moments when market algorithms swiftly push prices in their intended direction, regardless of the news itself. As traders, we can’t reliably predict how the market’s emotions will interpret good or bad news—sometimes it defies logic entirely. Good news might trigger sell-offs, while bad news could spark rallies. Instead of guessing, we should focus on reacting to live price action, letting it guide us based on how it aligns with our technical analysis.

Monday, June 30, 2025:

09:45 Chicago PMITuesday, July 1, 2025:

09:30 Fed Chair Powell Speaks

09:45 S&P Global Manufacturing PMI

10:00 ISM Manufacturing PMI

10:00 JOLTS Job OpeningsWednesday, July 2, 2025:

08:15 ADP Nonfarm Employment Change

10:30 Crude Oil InventoriesThursday, July 3, 2025:

Holiday United States - Independence Day - Early close at 13:00

08:30 Average Hourly Earnings

08:30 Initial Jobless Claims

08:30 Nonfarm Payrolls

08:30 Unemployment Rate

09:45 S&P Global Services PMI

10:00 ISM Non-Manufacturing PMIFriday, July 4, 2025:

All Day Holiday United States - Independence Day 🎇

📊 Here are charts of the larger patterns I’m watching below:

Hourly Chart From 6/29: We hit the monthly range high at 6,146 (marked as the purple level), a target identified June 1st 🎯. It’s also possible that month-end markup could drive the price to close above 6,146. Traders who targeted this level for the month should now be nearing full profit, and it may be wise to consider taking partial or full profits at this point. Additionally, there’s a confluence of the previous all-time high trendline and channel resistance around 6,230 expected to hold throughout Monday. A rejection at this level could push the price toward the channel’s midline. That said, I don’t depend solely on trendlines—they are just one element I combine with my algorithmically generated support and resistance levels to create a comprehensive analysis. Note that this assessment is based on June 29, 2025, and upcoming events like Fed Chair Powell's speech on July 1 could influence market movement. Always base your trades on the market's current conditions, not on predictions.

Daily Chart From 6/29:

Weekly Chart From 6/29: This is a weekly log scale chart of the S&P 500 dating back to 2009, which showcases its typical bullish pattern over the years. The chart indicates there’s still significant room for the price to move both upward and downward from its current level. It’s common for analysts to predict market tops when new all-time highs are reached, but based on this long-term view, the market doesn’t appear overextended. A hidden trendline at 0.75 of the rising channel aligns with a level of 6,320 for July, offering a key reference point. When studying a channel, you can identify support and resistance at the top, middle, bottom, and even fractional increments in between. Additionally, there’s a yellow rising wedge pattern visible below, but the recent upward surge makes me question the reliability of the lower trendline, especially since the price has already broken through it once.

📣 Announcement:

Indicator Update: I’m thrilled to announce Precision Levels 3.0, an updated version of my custom indicator I’ve developed for Trading View, now available in the Community Scripts section! This tool is designed to streamline your charting by semi-automatically highlighting the key price levels I share, making it easier to track critical support, resistance, and breakout zones. Visit the link below for a step-by-step guide on how to find, set up, and use this indicator in your Trading View charts.

👇 Below are Hyperlinks to previous content shared in this newsletter. I recommend reading through all of it to better understand how to use this information to secure your edge:

Overview of the Quantitative Algorithm

A Day Traders Guide to Using Support and Resistance

Disclaimer

All content provided by Precision Levels SPX, including but not limited to website materials, social media posts, videos, charts, technical analysis, and other communications, is for informational and educational purposes only. It does not constitute financial, investment, trading, or professional advice of any kind. Precision Levels SPX is not a regist…

i had a bwb for credit sitting at 75; the 81 pink line was money and helped keep me from losing that credit even on the tests lower