A Day Trader’s Guide to Using Support and Resistance Levels

Featuring a Breakdown of April 8th’s Price Action (2025)

Introduction: Why Levels Matter

Day trading is all about timing and precision. On April 8th, 2025, the market gave us a perfect example of how price interacts with support and resistance levels—key zones where price tends to bounce, reverse, or break through. As a trader, I use these levels to spot high-probability trades, whether I’m scalping for quick profits or holding for bigger moves. This guide explains my approach, breaks down real trades from that day, and shares practical tips to help you trade smarter. The concepts below summarize a topic I’ve explored in greater detail in a previous post. While my earlier newsletter (Thursday 4/10) wasn’t as clearly structured as this summary below, you can revisit it for more context in the link below:

Core Concepts: Understanding the Basics

Before we dive into the trades, here are the terms I use every day:

Support and Resistance Levels:

Support: A “floor” where buying kicks in, often stopping a drop (e.g., 5138).

Resistance: A “ceiling” where selling pressure builds, capping a rise (e.g., 5263).

These are my battlegrounds—price either respects them or breaks them.

Scalp Trade: A fast trade (minutes to hours) targeting small gains, like 5-30 points in the S&P 500. Speed is key.

Fresh Level: A level price hasn’t hit yet that day. First touches often spark big reactions since traders haven’t adjusted to them (e.g., 5187 at 7:36 AM).

Back Test: When price revisits a broken level to test it in a new role—like old resistance turning into support (e.g., 5187 at 11:12 AM). These can work, but they’re riskier.

My Trading Process: How I Use Levels

Here’s how I approach levels to make decisions, from prep to execution:

1. Pre-Market Prep (5-6 AM)

I start early, pulling up my charts in TradingView.

Freshness Check: If a level was hit overnight (e.g., 4897 at 2:30 AM), I see how long it’s been untouched. A gap—like 4897 staying clear until 7 AM—keeps it “fresh” for me. Thin overnight volume means less impact, so I prioritize levels untested when I’m active.

2. Defining a “Hit”

A level counts as hit if price lands within 1 point above or below (e.g., 5186-5188 for 5187). This buffers for front-running—price jumping ahead briefly.

3. First Touch Strategy

I enter trades on the first touch of a fresh level—my highest-probability setups.

Expectation: At least a 10-15 point reaction, often much more (e.g., 5263’s 355-point drop).

I scale out at 10, 15, or 20 points to lock profits, leaving a small position to catch bigger trends.

4. Back Test Trades

If a level breaks (e.g., by 15 points for 30+ minutes), it flips roles—support becomes resistance, or vice versa.

I watch for price to revisit these levels. A failure then retest often sets up a trade (e.g., 6043’s 20-point back test).

I use tools like moving averages or candlestick patterns to confirm before jumping in.

5. Risk Management

Hard stop: 11-15 points per trade.

Daily limit: Two losses, then I’m done.

Late-day caution: Red and Pink levels weaken near close if a trend has been established (e.g., after 2 PM), so I avoid reversal trades then or tighten stops.

6. Mindset

I wait for price to hit my levels—no chasing.

Goal: Grab a few wins early, then protect gains. Overtrading kills profits, so I stop when I’m ahead.

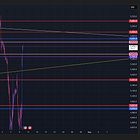

April 8th Breakdown: Levels in Action

Let’s walk through that day’s trades (3-minute chart) to see how my process played out. Each trade ties to a level, time, and outcome, with lessons for you.

Trade 1: 5187, 7:36 AM, +15 Points (Scalp Short)

What: Price hit fresh resistance at 5187 and rejected it. I shorted (bet on a drop) for a quick +15.

Why It Worked: Early sessions favor fresh levels—momentum wasn’t strong enough to break it.

Lesson: Scalping needs fast entries/exits. Lock in small gains before price flips.

Trade 2: 5263, 10:18 AM, +355 Points (Full Day Short)

What: Fresh resistance at 5263 triggered a huge rejection. I shorted and held for the majority of the 355-point drop.

Why It Worked: Bearish trend + fresh level = big potential. This was a “runner,” not a scalp.

Lesson: Read momentum. If a level aligns with the trend, let winners run.

Trade 3: 5187, 11:12 AM, -15 Points (Back Test Failed, Scalp Long)

What: Price revisited 5187 (old resistance, now support). I went long with options, but it failed, stopped out at 15 points.

Why It Failed: No confirmation (e.g., bounce or pattern)—it broke instead.

Lesson: Back tests need proof. Use a stop-loss—don’t assume a level holds.

Trade 4: 5138, 12:24 PM, +25 Points (Scalp Long)

What: Fresh support at 5138 held. I went long for a +25 bounce.

Why It Worked: Clean first touch with a quick reaction—textbook scalp.

Lesson: Spot fresh support on your chart and act when price confirms.

Trade 5: 5039, 1:30 PM, +60 Points (Scalp Long)

What: Fresh support at 5039 sparked a strong +60 bounce. Labeled a scalp, but I held longer.

Why It Worked: Momentum amplified the move—support was solid.

Lesson: Gauge strength. A “scalp” can grow if the market runs.

Trade 6: 4967, 2:18 PM, +30 Points (Scalp Long)

What: Fresh support at 4967 gave a +30 bounce. I missed it, avoiding overtrading.

Why It Worked: Late-day levels still hold if fresh.

Lesson: Stay sharp all day, but know when to quit—discipline wins.

Key Takeaways: What April 8th Teaches

Fresh Levels Rule: Five of six trades won at fresh levels (5187, 5263, 5138, 5039, 4967). Prioritize untested zones.

Back Tests Are Tricky: The -15 at 5187 shows risk—wait for confirmation.

Scalp or Hold: +15 to +60 were scalps; +355 was a runner. Match your exit to the move.

Risk Is King: Stops saved me at 5187. Define risk every trade.

Context Matters: Bearish bias (5263’s drop) shaped outcomes—check the trend.

Advanced Tips: Refining My Edge

Overnight Moves: I downplay overnight hits (e.g., 4897) due to low volume. Untested levels at my desk feel stronger.

Role Flips: A 15-point break for 30 minutes often switches a level’s role, but fast markets can whip back—watch live action.

Choppy Zones: If price stalls (e.g., 5585, 7-10 AM), I skip it—freshness fades.

Monthly Levels Ranges: My levels fit a 16-year back test—63% chance we close in range monthly. Use highs/lows as targets.

Final Thoughts: Build Your Skills

April 8th showed how levels drive trades—scalps, runners, and even a loss to learn from. Start simple: master fresh-level scalps on a demo account. Mark levels daily, wait for price to hit them, and practice timing. Patience and a plan beat chasing the market every time. Good luck!

Disclaimer

All content provided by Precision Levels SPX, including but not limited to website materials, social media posts, videos, charts, technical analysis, and other communications, is for informational and educational purposes only. It does not constitute financial, investment, trading, or professional advice of any kind. Precision Levels SPX is not a registered investment advisor, broker, or financial planner, and does not provide personalized investment recommendations or trading signals.

Investing and trading in financial markets, including stocks, options, futures, and other securities, involves a high degree of risk and may result in significant financial losses. Past performance is not indicative of future results. All individuals are solely responsible for their own investment research, decisions, and outcomes. Before making any investment or trading decisions, you should consult with a qualified financial advisor, broker, or other licensed professional to assess suitability, risks, and objectives. Thoroughly investigate and fully understand all risks associated with any investment or trading strategy before proceeding.

Precision Levels SPX makes no representations or warranties, express or implied, regarding the accuracy, completeness, timeliness, or suitability of the information provided. We do not guarantee the solvency, financial condition, or investment potential of any securities, strategies, or entities mentioned. Any reliance on the information provided is at your own risk.

To the fullest extent permitted by law, Precision Levels SPX, its affiliates, officers, employees, or contributors shall not be liable for any direct, indirect, incidental, consequential, or punitive damages, including but not limited to financial losses, lost profits, or emotional distress, arising from the use or inability to use our content, even if advised of the possibility of such damages. We are not responsible for any errors, omissions, or interruptions in the delivery of our content.

Trading and investing are not suitable for all individuals. Only risk capital—funds you can afford to lose—should be used for trading or investing. You acknowledge that you are solely responsible for evaluating the risks and potential losses associated with your financial decisions.

By accessing or using any content from Precision Levels SPX, you agree to indemnify and hold harmless Precision Levels SPX and its affiliates from any claims, losses, or liabilities arising from your use of our materials or your investment or trading activities.